Multi-Collateral

Collaterals

Max Deposits (Global)

These values represent the maximum amount of each collateral type (USDT or ETH) that can be deposited across all users on a global scale for the specified blockchain network (Arbitrum, Ethereum, or Base).

| Collateral | Chain | Max Collateral (global) |

|---|---|---|

| USDT | Arbitrum | 2,000,000 |

| ETH | Arbitrum | 1,000 |

| USDT | Ethereum | 3,000,000 |

| ETH | Ethereum | 500 |

| ETH | Base | 500 |

| USDT | BSC | 4,000,000 |

| YUSD | Ethereum | 500,000 |

| YUSD | BSC | 500,000 |

| SOL | SOL | 40,000 |

| BNB | BSC | 10,000 |

| WBTC | Ethereum | 80 |

Max Deposits (User)

| Collateral | Max Collateral |

|---|---|

| USDT | 500,000 |

| ETH | 100 |

| SOL | 2,000 |

| BNB | 500 |

| YUSD | 50,000 |

| WBTC | 5 |

What is Loan-to-value (LTV)?

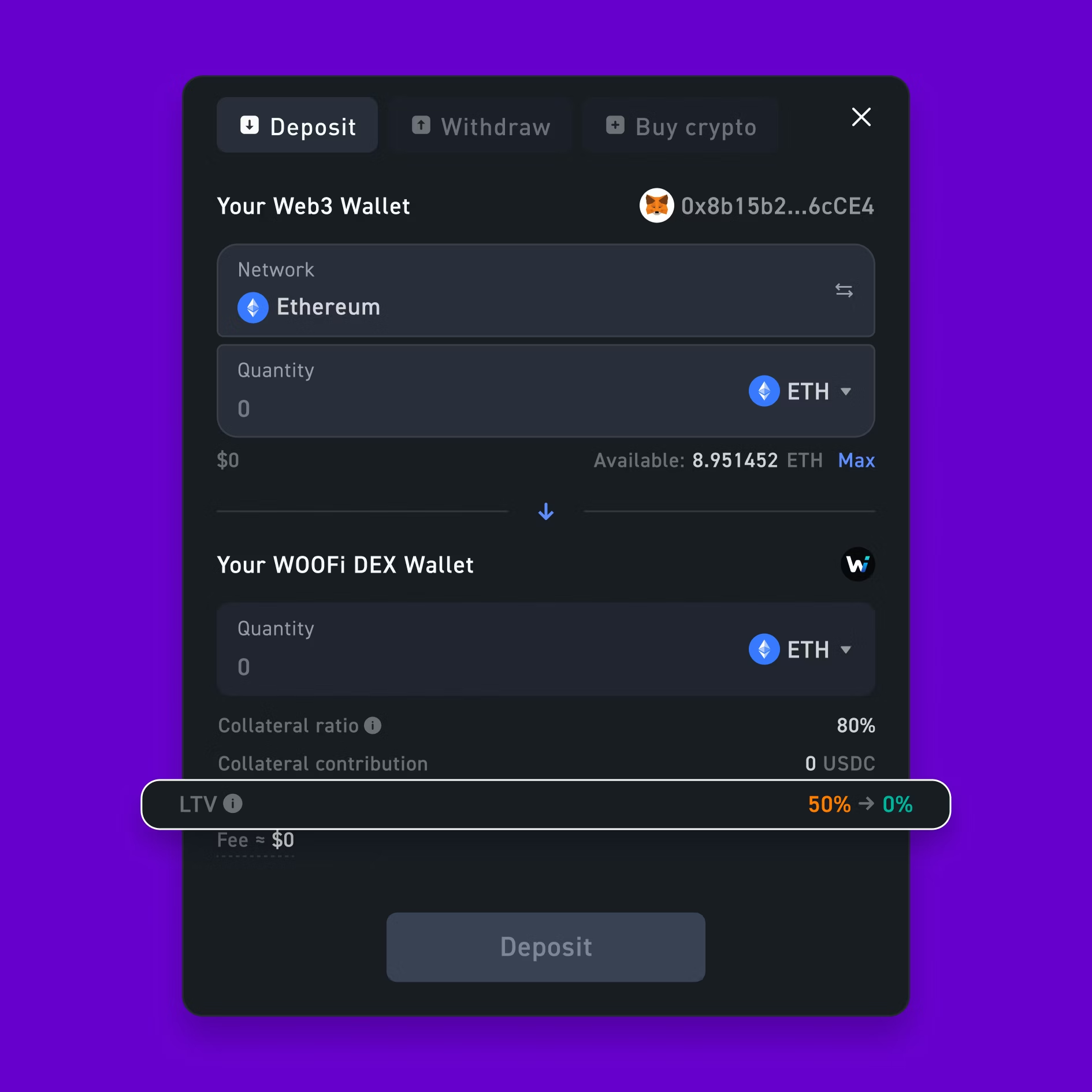

Loan-to-Value (LTV) is a key risk metric that measures the ratio of your negative USDC value which includes your negative balance (USDC_balance) and unrealized PnL (upnl), to your collateral's value. On Orderly, LTV replaces traditional credit scores to determine your borrowing power in our asset-backed lending system. A lower LTV signifies a safer loan.

By maintaining a healthy LTV, you can maximize the loan you can access while enhancing the safety of your position against market volatility. This empowers you to borrow with confidence. Your collateral is held securely by Orderly until the loan is repaid, providing a clear and powerful way for you to leverage your holdings.

How to calculate LTV

LTV = ( abs(min(USDC Balance, 0)) + abs(min(upnl, 0)) ) / [ sum( max(Collateral and Quantity × Index Price × Weight) + max(upnl, 0) ) ]| Term | Definition |

|---|---|

| USDC Balance | The total absolute USDC balance that has been borrowed |

| min(upnl, 0) | The isolated unrealized losses included |

| Collateral Quantity | The quantity of a specific asset you hold as collateral |

| Index Price | The current market price of the collateral |

| Weight | The collateral weight (refer to Collateral Ratio section) |

| max(upnl, 0) | The isolated unrealized profits included |

The acceptable range of LTV ratio remains below 95%. Auto conversion of collateral will be triggered if the LTV ratio reaches 95% and above.

Weight & Discount Collateral Factor

Weight and DCF will be determined based on the table below:

| Collateral | base_weight | DCF_i |

|---|---|---|

| USDT | 1 | 0.0000015 |

| ETH | 0.8 | 0.000007 |

| YUSD | 0.9 | 0.0000045 |

| SOL | 0.8 | 0.000007 |

| BNB | 0.8 | 0.000007 |

| WBTC | 0.8 | 0.000007 |

Collateral Calculations

Collateral Value

Collateral Value = min(Collateral Quantity, Collateral Cap) * Weight * Index PriceTotal Collateral Value

Total Collateral Value = sum(Collateral Value) + upnlFree Collateral

Free Collateral = Total Collateral Value - Total Initial Margin With OrdersTotal Account Value

Total Account Value = sum(Collateral Quantity * Index Price) + upnlAuto Conversion (Haircuts)

If a user's Loan-to-Value (LTV) ratio reaches the 95% threshold or a negative USDC value equivalent to -11,000, the system will automatically convert a necessary portion of their collateral into USDC. This action is designed to immediately reduce the LTV to a safer level, thereby helping to preserve the user's account.

This is a protective measure to manage risk. A lower LTV ratio results in a more secure position against this type of automated deleveraging.

Auto Conversion Fee (Haircuts)

| Collateral | Auto Conversion Fee (Haircuts) |

|---|---|

| USDT | 0.025% |

| ETH | 3.5% |

| YUSD | 0.035% |

| SOL | 3.5% |

| BNB | 3.5% |

| WBTC | 3.5% |

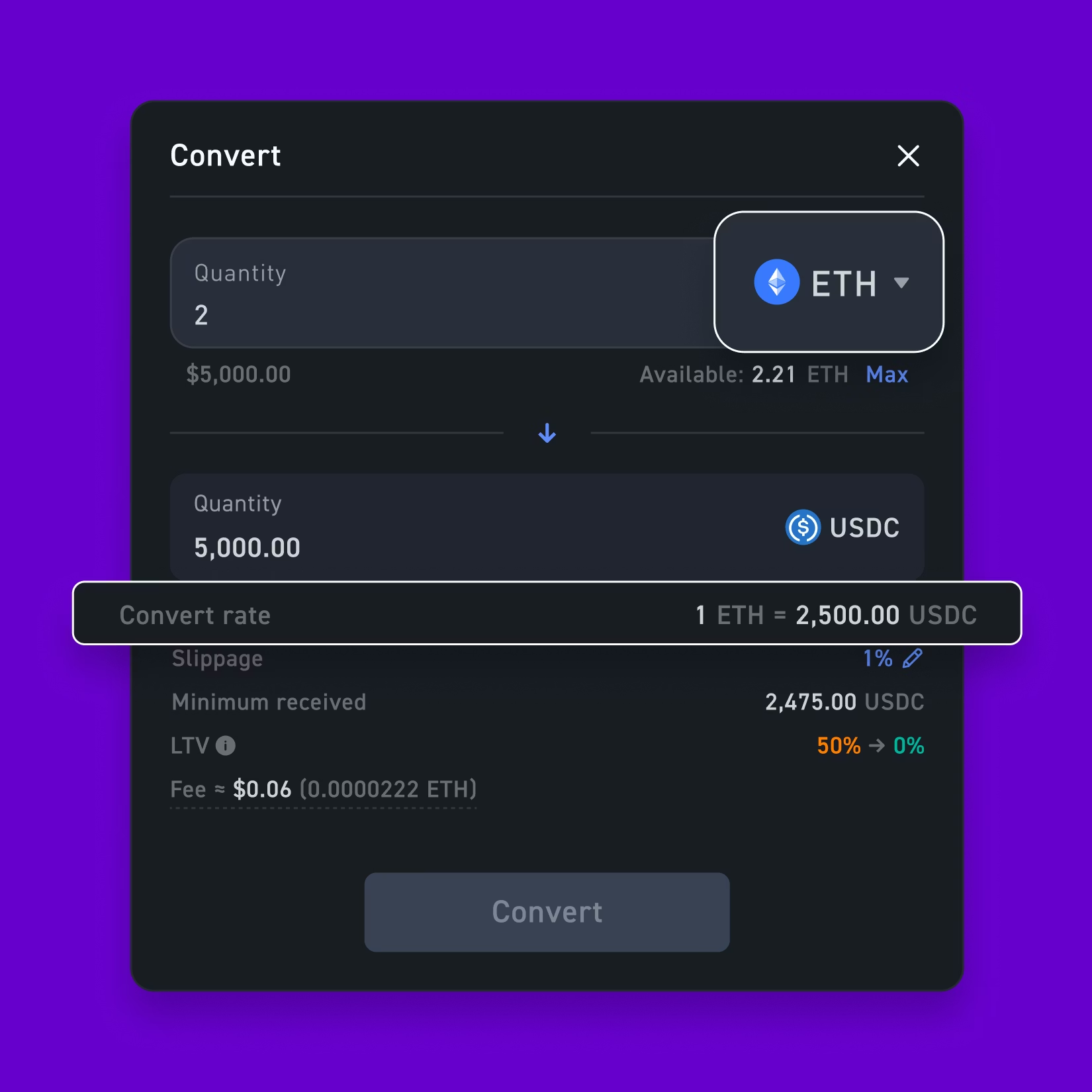

Manual Conversion

We recommend monitoring your LTV ratio to ensure it stays below the 95% and/or -11,000 USDC threshold. We permit manual conversion of collateral to assist with this maintenance via on-chain swaps.

Each collateral's minimum and maximum swap amount can be found in the table below:

Minimum Swap Collateral Required

| Collateral | Arbitrum & Base | Ethereum | Solana | BSC |

|---|---|---|---|---|

| USDT | 50 | 500 | 50 | 50 |

| ETH | 0.02 | 0.2 | - | - |

| YUSD | - | 500 | - | 50 |

| SOL | - | - | 2 | - |

| BNB | - | - | - | 0.5 |

| WBTC | - | 0.005 | - | - |

Maximum Swap Collateral Threshold

| Collateral | Arbitrum & Base | Ethereum | Solana | BSC |

|---|---|---|---|---|

| USDT | 500,000 | 1,000,000 | 500,000 | 500,000 |

| ETH | 100 | 500 | - | - |

| YUSD | - | 50,000 | - | 50,000 |

| SOL | 500 | - | - | - |

| BNB | - | - | - | 500 |

| WBTC | 5 | - | - | - |